Friendly Fraud: How Cyber Criminals Exploit Chargebacks to Scam Payment Processors

In the world of online transactions, fraudsters are always looking for ways to exploit weaknesses in the system. One particularly insidious form of fraud is known as friendly fraud, where two parties who know each other collude to scam the payment processor. In this article, we will explore what friendly fraud is, how it works, […]

What is a Chargeback Representment

Chargeback representment is the process by which a merchant disputes a chargeback, which occurs when a customer disputes a transaction and their issuing bank initiates a chargeback. Starting the representment process To start the representment process, the merchant must receive a chargeback notification from their acquiring bank, which includes information about the disputed transaction and […]

What is PCI Compliance

PCI Compliance stands for Payment Card Industry Compliance, which is a set of security standards created by major credit card companies like Visa, Mastercard, and American Express. These standards are designed to protect against credit card fraud and ensure that payment processing is done securely. Who needs to be PCI compliant? Any organization that accepts […]

What is P2PE Encryption

P2PE stands for “Point-to-Point Encryption.” It is a security technology that protects sensitive payment card information during transmission from the point of interaction (such as a card reader) to the secure environment of a payment processor, this could be IPP Europe. The goal of P2PE is to reduce the risk of data breaches and theft […]

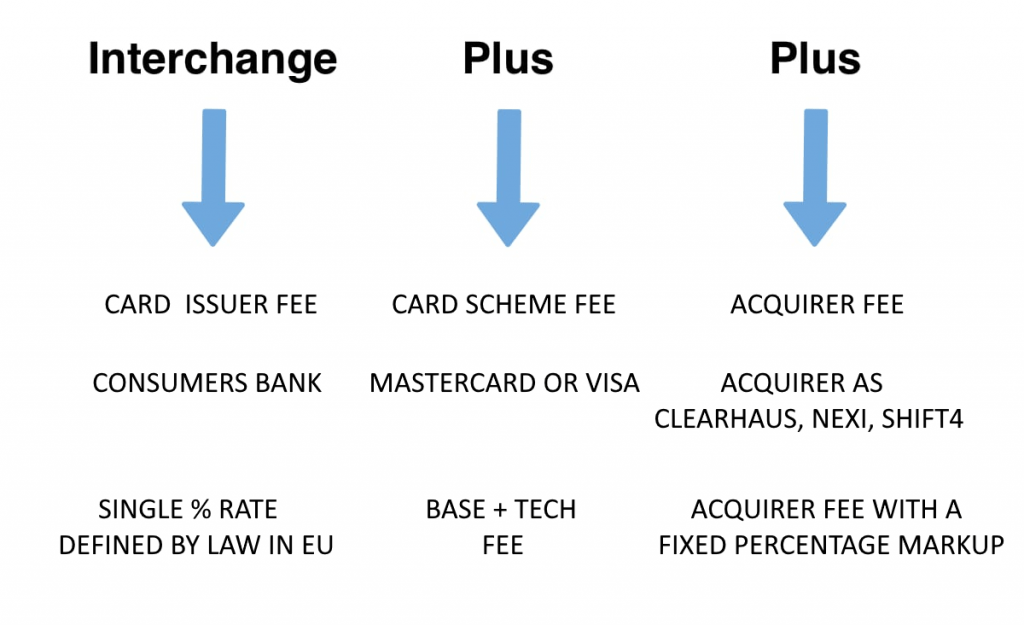

What is IC++ pricing models

The IC++ pricing model is a pricing strategy used by some acquiring banks for processing credit and debit card transactions. IC++ stands for Interchange++. The combination of costs with Interchange An IC++ pricing model is a pricing structure used for card payments. It stands for “Interchange Cost Plus” and involves adding a markup to the […]

What is a Payment Service Provider (PSP)

Payment Service Providers (PSPs) are third-party companies that offer payment processing services to businesses and merchants. These services allow merchants to accept electronic payments from customers, including credit and debit cards, mobile payments, and online payment systems. PSPs play a crucial role in the modern economy, facilitating billions of dollars in transactions every day. Overall, […]

Avoid PCI complexity – by thinking forward

In this post we will talk about PCI DSS, the different types of PCI compliance, the cost and how difficult it is to obtain it. What is PCI and why does Fintechs talk about it The Payment Card Industry Data Security Standard, is a set of requirements intended to ensure that all companies that process, […]

What is Open Source

Open source refers to sharing software source code with the public. It started from hacker culture in the 60s and 70s, but the term “open source” wasn’t widely used until the late 90s. Year 1998 The Open Source Initiative was founded in 1998 to promote open source and define it. The organization’s definition, called the […]

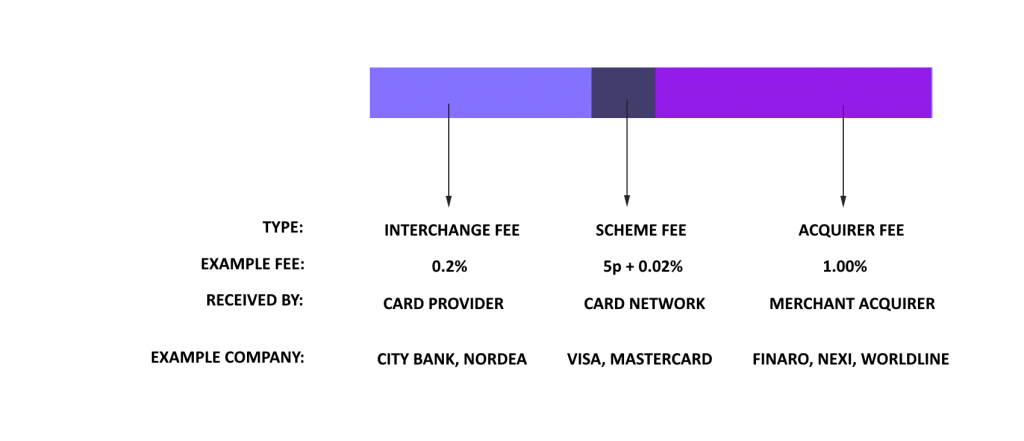

What is Scheme Fees

Card scheme fees are the fees that credit card networks like Visa, Mastercard, American Express, and Discover charge for processing your credit card transactions. Who gets paid When you make a purchase with your credit card, the fee for processing that transaction is paid by the bank that handles the transaction (called the acquiring bank) […]

Start the Payment Gateway, by selling first

Intro Building Payment Gateways have always been a developer-driven service, where technology have been handled first, and then afterwards have has the clever sales started. One of our biggest opportunities when we created IPP, was the chance to change this. Simply, by democratizing the software – and enabling new feature sets for the broader market. […]