Friendly Fraud: How Cyber Criminals Exploit Chargebacks to Scam Payment Processors

In the world of online transactions, fraudsters are always looking for ways to exploit weaknesses in the system. One particularly insidious form of fraud is

Follow bloggers from our local markets

In the world of online transactions, fraudsters are always looking for ways to exploit weaknesses in the system. One particularly insidious form of fraud is

Chargeback representment is the process by which a merchant disputes a chargeback, which occurs when a customer disputes a transaction and their issuing bank initiates

PCI Compliance stands for Payment Card Industry Compliance, which is a set of security standards created by major credit card companies like Visa, Mastercard, and

P2PE stands for “Point-to-Point Encryption.” It is a security technology that protects sensitive payment card information during transmission from the point of interaction (such as

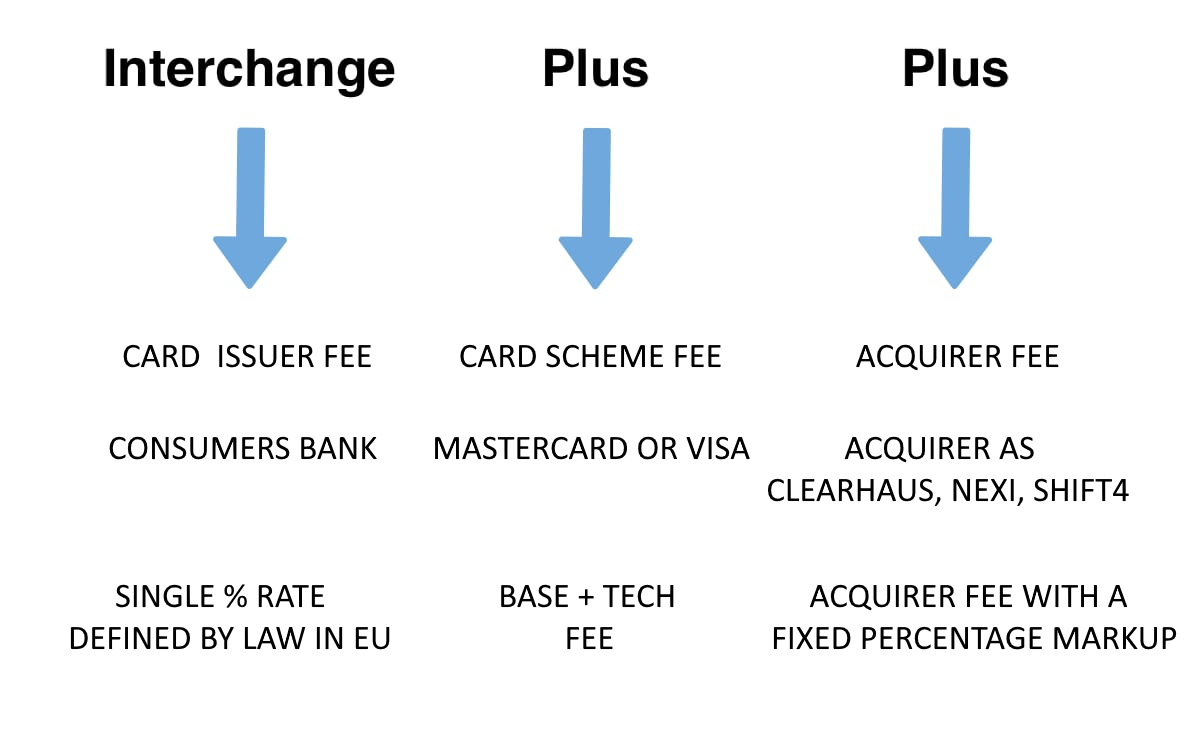

The IC++ pricing model is a pricing strategy used by some acquiring banks for processing credit and debit card transactions. IC++ stands for Interchange++. The

Payment Service Providers (PSPs) are third-party companies that offer payment processing services to businesses and merchants. These services allow merchants to accept electronic payments from

Select a time to speak with us, and let us show how IPP can improve and increase your success with payments.

IPP Europe company registration no (CVR) 40153292, is yearly certified with the standards of the Payment Card Industry, defined by Visa, MasterCard, American Express, JCB and Discover.

IPP (under the brand name of Phoenix Systems ApS) Holds permission to operate as an Payment Service Provider and a Service Vendor on the Card Schemes, based on the above approvals.