Title: Demystifying VISA: Your Guide to their Role in EU's Payment Sector

Hey payment enthusiasts! Let’s explore the dynamic world of payment service providers, with our spotlight on the mighty VISA – the name that spells secure and swift transactions like no other.

So, who’s VISA, you ask? Imagine a global bridge connecting merchants, consumers, and businesses, smoothly moving funds while keeping your data locked safe. That’s VISA – not just a card, but a trusted financial companion.

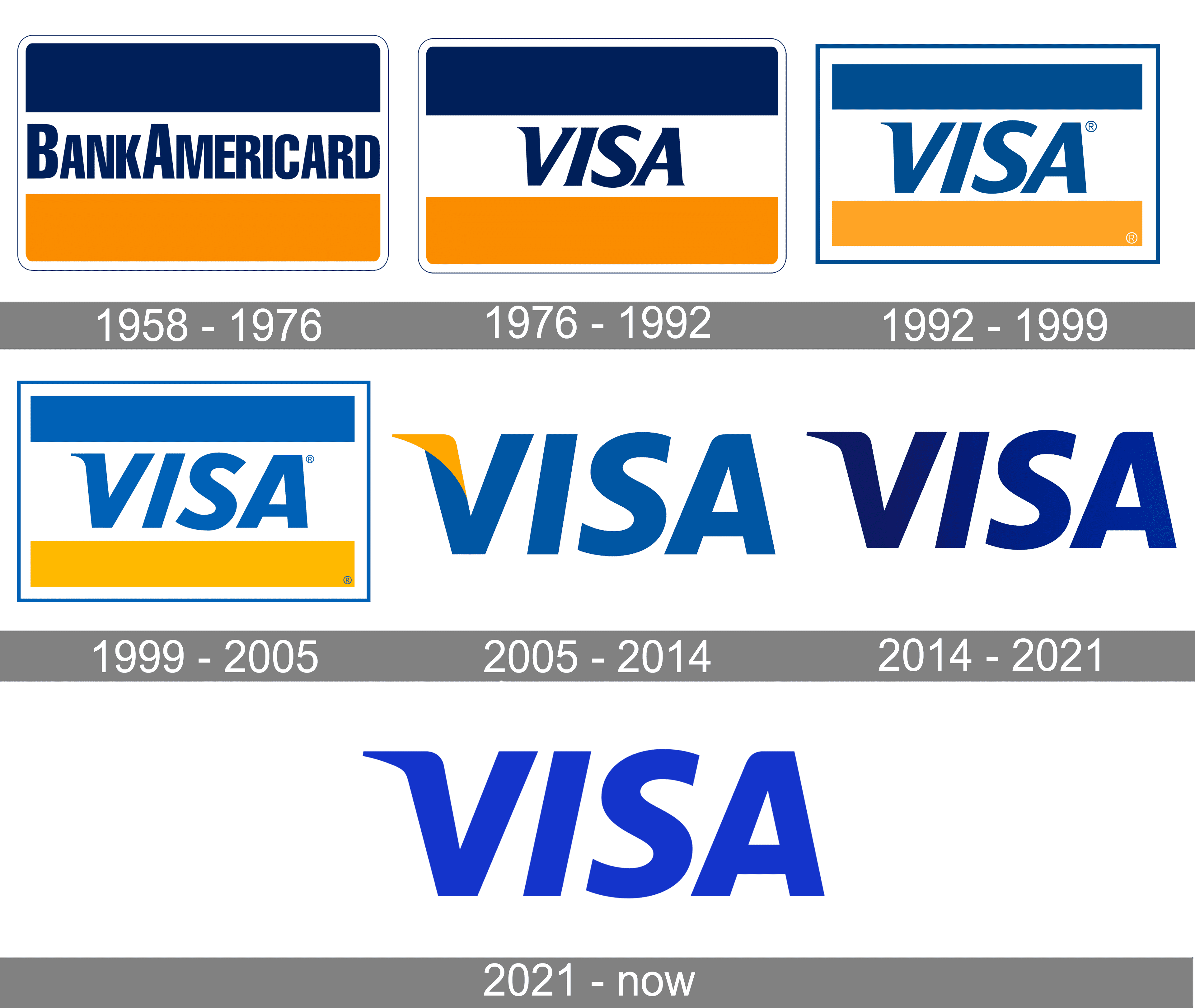

In the bustling realm of payment service providers, VISA shines as a beacon of importance. Its significance in the payment sector spans decades, adapting to new technologies and reshaping how we handle money.

Now, let’s peek at VISA’s role in the European Union. While we sip coffee in cozy cafes, VISA works behind the scenes, ensuring secure cross-border transactions. Its EU presence goes beyond transactions; it nurtures businesses and empowers consumers to shop confidently across borders.

But every hero has its challengers, right? In the world of Fintech, VISA isn’t alone. It competes with the likes of Mastercard, each adding their unique touch. Rising stars like PayPal and Apple Pay also join the payments game, adding to the excitement.

As a Fintech enthusiast in the EU, you’re familiar with payment facilitators. VISA fits seamlessly, offering tailored solutions for businesses and individuals. Their collaboration with payment service providers keeps the ecosystem buzzing.

Whether you’re an entrepreneur in online commerce or an avid shopper exploring trends, VISA is your constant companion. In the evolving EU payment landscape, VISA remains your guardian, ensuring secure and boundless financial ventures.

VISA isn’t just a company; it’s a dream enabler, a transaction guardian, and a catalyst for progress. So, next time you tap your card, remember VISA – the powerhouse shaping Fintech and payments.

That’s VISA in the symphony of EU payments – harmonious, empowering, timeless.