A credit card holder can reverse a transaction through the chargeback process if they believe it was unauthorized, the product was not as described, or if there was fraudulent activity on their account.

The credit card issuer will investigate the claim and, if they agree, they will refund the money to the cardholder and charge it back to the merchant’s account.

What do do, if you get a chargeback?

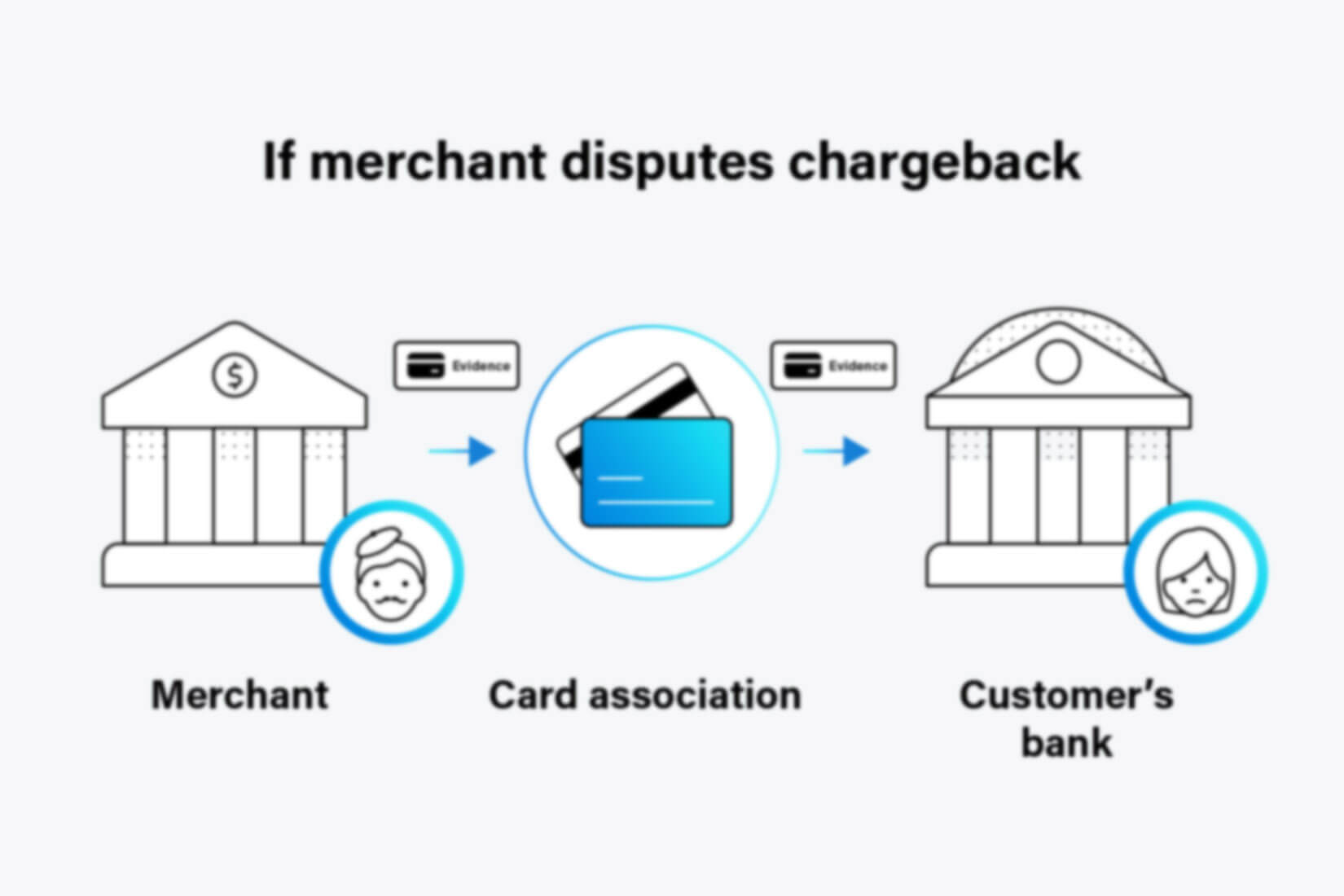

As a merchant facing a chargeback claim, you can dispute it if you believe it’s in error. Here’s what to do:

- Review the reason: Understand why the cardholder disputed the charge.

- Gather evidence: Get receipts, invoices, proof of delivery, and any other supporting documents.

- Respond: Submit evidence to the acquiring bank and explain why the reversal is invalid.

- Consider mediation: If evidence is strong, consider resolving the dispute through mediation.

- Prepare for representment: If the dispute isn’t resolved, resubmit the charge to the credit card issuer for a final decision.

Respond promptly to a chargeback with as much evidence as possible to increase your chances of winning. Reduce future chargebacks by reviewing your history and improving product descriptions and delivery processes.

The decision process

The credit card issuer or acquiring bank usually makes the decision on a chargeback.

They examine the evidence from the cardholder and merchant and choose a winner based on the card network’s rules (such as Visa or Mastercard).

During a chargeback dispute, the credit card issuer or acquiring bank considers the reason for the dispute, the available evidence, and the card network’s guidelines. To ensure fairness, a neutral third party may get involved in resolving the dispute.

It is costful for you as a Merchant get a chargeback?

Yes, it is not free to get a claim. While there is no direct fee charged to the cardholder for initiating a chargeback, there can be indirect costs involved.

For example, you as the merchant may charge a fee to cover the cost of the goods or services, even if the chargeback is successful.

Additionally, you may also incur fees from their acquiring bank for each chargeback, which can add up over time.

Furthermore, merchants with a high number of chargebacks may face increased processing costs. Ultimately the merchant can have the ability to accept credit cards suspended. As a result, chargebacks can be a costly process for both cardholders and merchants, which is why it’s important to try to resolve disputes through alternative means before resorting to a chargeback.

This happens, when you win the claim

If a merchant wins a chargeback dispute, the credit card issuer or bank will usually cancel the chargeback and give the merchant their money back. This is good for the merchant as they get their funds returned. It also helps improve their standing with the bank or issuer.

But, it’s important to remember that winning the claim doesn’t guarantee payment from the customer. The merchant may still need to take further steps to get paid.